Tamil Nadu RERA Mandates Three Separate Bank Accounts to Safeguard Homebuyer Funds

Introduction: A Major Step Towards Financial Transparency in Real Estate

The real estate sector in India has long struggled with issues such as diversion of funds, delayed possession, stalled projects, and lack of transparency. While the Real Estate (Regulation and Development) Act, 2016 (RERA) was enacted to address these problems, practical loopholes continued to exist in how project funds were collected and utilised.

Recognising this gap, the Tamil Nadu Real Estate Regulatory Authority (TN RERA) has introduced a path-breaking financial control mechanism. Through an order dated 12 December 2025, TN RERA has mandated that every registered real estate project must operate three separate and designated bank accounts. This requirement applies to all project registrations and resubmissions received from 1 January 2026 onwards.

This move is aimed squarely at protecting homebuyer money, preventing cross-project fund diversion, and ensuring that money collected for a project is used only for that project.

Background: What RERA Already Mandates and Why It Was Not Enough

The Existing Legal Position Under RERA

Section 4(2)(l)(D) of the RERA Act requires promoters to:

-

Deposit 70% of the amounts realised from allottees

-

In a separate bank account

-

To be used only for land cost and construction cost

-

With withdrawals permitted only after certification by:

-

Architect

-

Engineer

-

Chartered Accountant

-

This provision was designed to ensure project-specific fund usage and to prevent promoters from diverting money to other projects.

The Practical Problem Identified by TN RERA

Despite this legal safeguard, TN RERA observed a critical gap at the collection stage:

-

Homebuyer payments were often received in ordinary bank accounts

-

These collection accounts were not monitored by the Authority

-

Promoters frequently:

-

Used one common collection account for multiple projects

-

Transferred funds to the RERA account after delays

-

Moved money between projects before regulatory oversight applied

-

TN RERA clearly noted that “there is no mechanism to monitor the collection account”, which defeated the very purpose of RERA.

The TN RERA Order of December 12, 2025: What Has Changed?

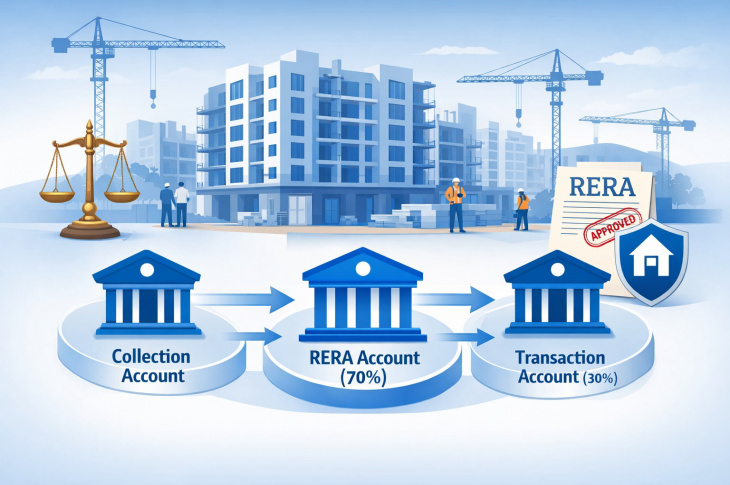

To close this loophole, TN RERA has introduced a three-tier banking system for every real estate project.

Applicability of the New Rule

-

Applies to:

-

All new project registrations

-

All resubmission applications

-

-

Effective for applications received on or after 1 January 2026

-

Mandatory compliance for:

-

Promoters

-

Developers

-

Joint development projects

-

The Three Mandatory Bank Accounts Explained Simply

Under the new TN RERA framework, every project must have three designated bank accounts, all opened:

-

In the same scheduled bank

-

In the same branch

-

Specifically linked to the individual project

Let us understand each account in detail.

1. Collection Account: Where All Homebuyer Money First Lands

Purpose of the Collection Account

The collection account is the first point of entry for all money paid by homebuyers.

Key Rules Governing the Collection Account

-

All payments from allottees must be credited only to this account

-

No cash diversion or alternate accounts allowed

-

No withdrawals permitted

-

No cheques, transfers, or manual debits allowed

Automatic Sweep Mechanism

Funds can leave the collection account only through an automated sweep process, ensuring:

-

No human discretion

-

No delay in regulatory tracking

-

No opportunity for misuse

This mechanism ensures that every rupee paid by a homebuyer enters the regulatory ecosystem immediately.

2. Separate RERA Account (70% Account): The Core Safeguard

Mandatory Same-Day Transfer of 70%

-

70% of the amount collected

-

Must be transferred on the same day

-

Automatically swept into the separate RERA account

Permitted Uses of the RERA Account

Money in this account can be used only for:

-

Land cost

-

Construction cost

-

Development work

-

Refund of principal amounts to allottees (up to 70%)

Conditions for Withdrawal

Withdrawals are permitted only after submission of:

-

Architect’s certificate

-

Engineer’s certificate

-

Chartered Accountant’s certificate

This ensures withdrawals are linked to actual construction progress.

Important Restriction on Refunds

-

Refunds from this account are capped at 70%

-

Prevents misuse of construction funds for non-project liabilities

3. Transaction Account (30% Account): Controlled Operational Flexibility

Transfer of Remaining 30%

-

The remaining 30% of collections

-

Automatically transferred to the transaction account

Additional Credits Allowed

This account may also receive:

-

Promoter’s own funds

-

Project loans (secured or unsecured)

Permitted Uses of the Transaction Account

Funds can be used for:

-

Marketing and sales expenses

-

Administrative costs

-

Loan repayments and interest

-

Compensation to allottees

-

Penalties imposed by TN RERA

-

Refunds up to 30% of payable amount

This account provides necessary operational flexibility while remaining fully traceable.

Special Rules for Joint Development Projects (JDA)

Two Sets of Three Accounts Mandatory

For projects developed under joint development agreements:

-

Two complete sets of accounts must be opened:

-

One for the landowner

-

One for the promoter

-

-

This applies regardless of the number of landowners or promoters

Why This Is Important

Joint development projects often face disputes over:

-

Revenue sharing

-

Fund utilisation

-

Responsibility for delays

Separate account structures ensure:

-

Clear financial demarcation

-

Accountability of each stakeholder

-

Protection of homebuyer interests

Stricter Disclosure Norms for Project Loans

Mandatory Loan Disclosures

Promoters must now disclose complete loan details, including:

-

Name of lender

-

Sanctioned amount

-

Disbursed amount

-

Outstanding dues

-

Mortgage or charge details

Chartered Accountant Certification

A CA must certify that:

-

Loan funds are used exclusively for the project

-

No cross-project utilisation has occurred

Disclosure of Post-Registration Loans

-

Any loan taken after project registration

-

Must be disclosed immediately

-

All repayments must be routed only through the transaction account

This brings unprecedented transparency to project financing.

Fixed Deposits from the 70% RERA Account: Allowed With Safeguards

TN RERA has permitted promoters to park funds from the 70% account in fixed deposits, subject to strict conditions:

-

FD must be no-lien

-

Cannot be used to raise loans

-

Cannot create charges or encumbrances

-

Maturity proceeds must return only to the same RERA account

This balances financial prudence with homebuyer protection.

Change of Bank Accounts: No Longer at Promoter’s Discretion

Prior Written Approval Mandatory

Promoters must obtain prior written approval from TN RERA for:

-

Any change in:

-

Bank

-

Branch

-

Account details

-

Post-Completion Withdrawals

Remaining balances in all three accounts can be withdrawn only after:

-

Completion report is issued by TN RERA

-

Authority communicates approval to the concerned bank

This ensures funds remain protected until the very end of the project lifecycle.

How This Order Strengthens Homebuyer Protection

Key Benefits for Homebuyers

-

Eliminates fund diversion at the collection stage

-

Ensures project-specific fund usage

-

Improves chances of timely completion

-

Enhances refund security

-

Builds trust in regulated projects

For homebuyers, this order translates into real financial safety, not just legal promises.

Impact on Developers and Promoters

Increased Compliance, But Greater Credibility

While promoters face:

-

Higher compliance costs

-

Increased disclosures

-

Tighter controls

They also gain:

-

Improved credibility with buyers

-

Better access to institutional finance

-

Reduced litigation risk

-

Clear financial discipline

Serious and ethical developers stand to benefit the most.

Comparison with Other State RERA Authorities

While several states enforce the 70% rule, Tamil Nadu’s three-account system is among the most robust and structured in India.

It addresses not just usage, but also collection, movement, and final settlement of funds, making it a potential model for nationwide adoption.

Practical Takeaways for Homebuyers

Before booking a property in Tamil Nadu:

-

Check if the project is TN RERA registered

-

Verify compliance with the three-account framework

-

Ask for disclosures relating to:

-

Project loans

-

Completion timelines

-

-

Prefer projects registered after January 1, 2026

An informed buyer is a protected buyer.

Conclusion: A Game-Changer for Tamil Nadu’s Real Estate Sector

The TN RERA order mandating three separate bank accounts per project marks a decisive shift from reactive regulation to proactive financial governance.

By bringing every rupee of homebuyer money under regulatory oversight from the moment of collection, the Authority has significantly reduced the scope for misuse, delays, and project failures.

For homebuyers, this is a powerful safeguard.

For ethical developers, it is a credibility booster.

For the real estate sector, it is a step towards long-term trust and sustainability.

Tamil Nadu has set a new benchmark—one that prioritises transparency, accountability, and consumer confidence at the heart of real estate development.

Download the Judgment Here:

Supreme Court JudgmentFrequently asked questions

What is the new TN RERA rule about three separate bank accounts?

What is the new TN RERA rule about three separate bank accounts?

TN RERA has made it mandatory for every registered real estate project to operate three designated bank accounts—a Collection Account, a Separate RERA Account (70%), and a Transaction Account (30%)—to ensure complete transparency and prevent misuse of homebuyer funds.

From when is this three-bank-account rule applicable?

From when is this three-bank-account rule applicable?

The rule applies to all project registration and resubmission applications received from 1 January 2026 onwards, as per the TN RERA order dated 12 December 2025.

Why did TN RERA introduce this new system?

Why did TN RERA introduce this new system?

TN RERA found that promoters were often collecting money in ordinary bank accounts that were not monitored, allowing fund diversion across projects. The new system brings regulatory control from the very first rupee collected from homebuyers.

What is a Collection Account and can promoters withdraw money from it?

What is a Collection Account and can promoters withdraw money from it?

The Collection Account is where all homebuyer payments are first credited.

No withdrawals are allowed from this account.

Funds can move out only through an automatic sweep mechanism, ensuring zero manual interference.

What is the Separate RERA Account and how can funds be used?

What is the Separate RERA Account and how can funds be used?

The Separate RERA Account receives 70% of the collected amount on the same day.

Funds can be used only for:

-

Land cost

-

Construction and development work

-

Refund of principal to allottees (up to 70%)

Withdrawals require certificates from an architect, engineer, and chartered accountant.

What expenses can be paid from the Transaction Account (30%)?

What expenses can be paid from the Transaction Account (30%)?

The Transaction Account can be used for:

-

Marketing and administrative expenses

-

Loan repayments and interest

-

Compensation to homebuyers

-

Penalties imposed by TN RERA

-

Refunds up to 30% of the payable amount

It may also receive promoter funds and project loans.

Are joint development projects covered under this rule?

Are joint development projects covered under this rule?

Yes. For joint development agreements (JDAs), TN RERA has mandated two complete sets of three accounts:

-

One set for the landowner

-

One set for the promoter

This applies regardless of the number of landowners or developers involved.

Are promoters allowed to take project loans under the new framework?

Are promoters allowed to take project loans under the new framework?

Yes, but with strict disclosure requirements. Promoters must disclose:

-

Lender details

-

Loan amount sanctioned and disbursed

-

Outstanding dues

-

Mortgage or charge details

A chartered accountant must certify that the loan is used only for the specific project.

Can funds from the 70% RERA account be placed in fixed deposits?

Can funds from the 70% RERA account be placed in fixed deposits?

Yes, but only under strict safeguards:

-

FD must be no-lien

-

Cannot be used to raise loans

-

Maturity amount must return only to the same RERA account

This ensures safety while allowing limited financial planning.

When can promoters withdraw the remaining balance after project completion?

When can promoters withdraw the remaining balance after project completion?

Promoters can withdraw remaining balances only after:

-

TN RERA issues a completion report

-

The Authority formally communicates approval to the concerned bank

Without TN RERA’s approval, funds remain locked—even after project completion.

Trending

Frequently asked questions

What is the new TN RERA rule about three separate bank accounts?

What is the new TN RERA rule about three separate bank accounts?

TN RERA has made it mandatory for every registered real estate project to operate three designated bank accounts—a Collection Account, a Separate RERA Account (70%), and a Transaction Account (30%)—to ensure complete transparency and prevent misuse of homebuyer funds.

From when is this three-bank-account rule applicable?

From when is this three-bank-account rule applicable?

The rule applies to all project registration and resubmission applications received from 1 January 2026 onwards, as per the TN RERA order dated 12 December 2025.

Why did TN RERA introduce this new system?

Why did TN RERA introduce this new system?

TN RERA found that promoters were often collecting money in ordinary bank accounts that were not monitored, allowing fund diversion across projects. The new system brings regulatory control from the very first rupee collected from homebuyers.

What is a Collection Account and can promoters withdraw money from it?

What is a Collection Account and can promoters withdraw money from it?

The Collection Account is where all homebuyer payments are first credited.

No withdrawals are allowed from this account.

Funds can move out only through an automatic sweep mechanism, ensuring zero manual interference.

What is the Separate RERA Account and how can funds be used?

What is the Separate RERA Account and how can funds be used?

The Separate RERA Account receives 70% of the collected amount on the same day.

Funds can be used only for:

-

Land cost

-

Construction and development work

-

Refund of principal to allottees (up to 70%)

Withdrawals require certificates from an architect, engineer, and chartered accountant.

What expenses can be paid from the Transaction Account (30%)?

What expenses can be paid from the Transaction Account (30%)?

The Transaction Account can be used for:

-

Marketing and administrative expenses

-

Loan repayments and interest

-

Compensation to homebuyers

-

Penalties imposed by TN RERA

-

Refunds up to 30% of the payable amount

It may also receive promoter funds and project loans.

Are joint development projects covered under this rule?

Are joint development projects covered under this rule?

Yes. For joint development agreements (JDAs), TN RERA has mandated two complete sets of three accounts:

-

One set for the landowner

-

One set for the promoter

This applies regardless of the number of landowners or developers involved.

Are promoters allowed to take project loans under the new framework?

Are promoters allowed to take project loans under the new framework?

Yes, but with strict disclosure requirements. Promoters must disclose:

-

Lender details

-

Loan amount sanctioned and disbursed

-

Outstanding dues

-

Mortgage or charge details

A chartered accountant must certify that the loan is used only for the specific project.

Can funds from the 70% RERA account be placed in fixed deposits?

Can funds from the 70% RERA account be placed in fixed deposits?

Yes, but only under strict safeguards:

-

FD must be no-lien

-

Cannot be used to raise loans

-

Maturity amount must return only to the same RERA account

This ensures safety while allowing limited financial planning.

When can promoters withdraw the remaining balance after project completion?

When can promoters withdraw the remaining balance after project completion?

Promoters can withdraw remaining balances only after:

-

TN RERA issues a completion report

-

The Authority formally communicates approval to the concerned bank

Without TN RERA’s approval, funds remain locked—even after project completion.

Ask a Lawyer