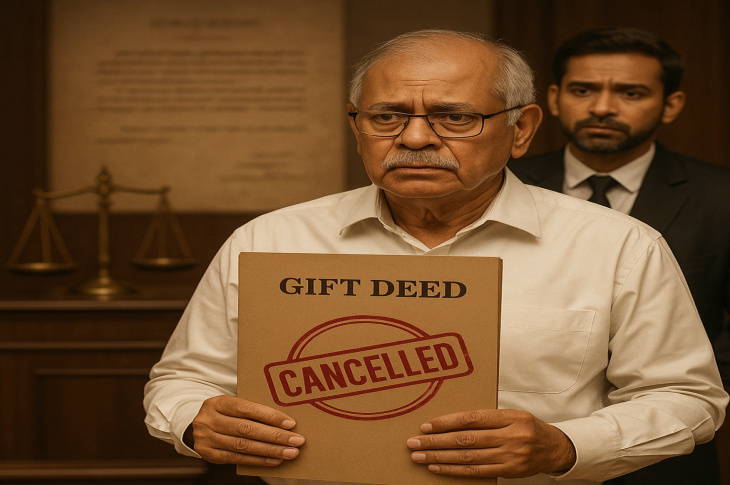

How to Cancel a Gift Deed: Key Legal Grounds & Time Limits

Gifting immovable property such as land, flats, or houses is a common practice in India, often driven by familial love, gratitude, or spiritual belief. However, there are situations where the donor—the one who gifts—may want to take back what was given. This leads us to an important legal concept: Cancellation or Revocation of a Gift Deed.

In India, once a Gift Deed is registered, it cannot be revoked easily. However, there are certain circumstances where the law permits cancellation.

People Also Read: Madras HC: Mother Cannot Cancel Gift Deed Executed by Father, and Vice‑Versa – Detailed Legal Analysi

What is a Gift Deed?

A Gift Deed is a legal document used to voluntarily transfer ownership of movable or immovable property from one person (donor) to another (donee) without monetary consideration. It must be executed on a non-judicial stamp paper and registered under Section 17 of the Registration Act, 1908 to be legally valid.

Essential elements:

-

Voluntary act

-

Without monetary consideration

-

Acceptance by the donee

-

Transfer of ownership

People Also Read: Madras High Court: Parents Can Revoke Gift Deeds to Children Who Neglect Them

Can a Gift Deed Be Cancelled?

Yes, a Gift Deed can be cancelled under certain circumstances. Once registered, a gift deed is irrevocable, unless:

-

A revocation clause is mentioned in the deed

-

There’s mutual agreement

-

Legal grounds such as fraud, coercion, or mistake are proven in court

People Also Read: Gift Deed In India An Overview

Who Can File for Cancellation?

Primarily, the donor—the person who gave the property—has the legal right to initiate cancellation. In certain circumstances, legal heirs, guardians (if donor is a minor or mentally unfit), or a representative with Power of Attorney can also approach the court.

People Also Read: Wills vs. Gift Deeds: Navigating Your Estate Planning Options

Legal Grounds for Cancelling a Gift Deed

1. Fraud or Misrepresentation (Section 17, Indian Contract Act, 1872)

If the donor was tricked into gifting the property through deceit, false promises, or misinformation, the deed can be revoked. Fraud must be proven in court with evidence.

Example: A son promises lifelong care for his father in exchange for a flat but abandons him after receiving the gift.

2. Coercion or Undue Influence (Sections 15 & 16, Indian Contract Act, 1872)

If the donor was pressured, emotionally manipulated, or influenced due to a position of power or trust (e.g., child, caretaker), the Gift Deed can be invalidated.

Example: A bedridden elderly woman signs over her home to a caretaker who coerced her during her illness.

3. Failure to Fulfil Conditions (Section 126, Transfer of Property Act, 1882)

If the gift was conditional and those conditions are violated, the donor can revoke the deed. The conditions must be clearly stated in the Gift Deed at the time of execution.

Example: A gift deed says the house will be gifted only if the donee takes care of the donor till death. If the donee neglects this, revocation is possible.

4. Non-Acceptance by Donee (Section 122, Transfer of Property Act, 1882)

A gift is incomplete without acceptance. If the donee refuses to accept the gift during the donor's lifetime, the deed is void and can be cancelled.

5. Lack of Delivery of Possession (Section 123, Transfer of Property Act, 1882)

For immovable property, mere registration is not enough. If physical or legal possession was not delivered, the gift may be considered incomplete.

6. Forgery or Tampering

If the Gift Deed is forged or tampered with—either signatures faked or contents altered—it is not enforceable and can be challenged both civilly and criminally.

7. Illegality or Immorality (Section 23, Indian Contract Act, 1872)

If the Gift Deed was executed for an illegal or immoral purpose, it can be struck down.

Example: Gifting property in exchange for future illegal support (like shielding criminal activity).

8. Mutual Agreement

Both parties can mutually agree to cancel the Gift Deed. The donor and donee must sign a Deed of Cancellation, and it should be registered under the Registration Act.

9. Death of Donor Before Acceptance

If the donor dies before the donee formally accepts the gift, the deed is void.

10. Inadequate Stamp Duty or Non-Registration (Section 17, Registration Act, 1908)

A gift deed must be registered and stamped as per the applicable state laws. Failure to do so can render the deed legally invalid.

11. Incompetency of Donor

If the donor was:

-

A minor

-

Of unsound mind

-

Under intoxication

…at the time of executing the deed, it is voidable.

People Also Read: Know Various Aspects About The Gift Deed and Stamp Duty

Legal Procedure to Cancel a Gift Deed in India

Step 1: Legal Consultation

Hire a property lawyer to evaluate the deed and suggest a viable legal ground for cancellation.

Step 2: Draft and File a Civil Suit

A cancellation petition is filed under Section 31 of the Specific Relief Act, 1963 in the civil court where the property is situated.

Step 3: Court Issues Notice

The court will issue notices to the donee and other concerned parties.

Step 4: Present Evidence

The donor must provide solid documentary evidence or witnesses to prove the claim (fraud, coercion, non-fulfilment of condition, etc.).

Step 5: Court Hearing

Both parties will be heard. If the judge is satisfied, they will order cancellation of the deed.

Step 6: Registry Update

The order must be presented to the local Sub-Registrar Office, and the gift deed will be marked as cancelled in official property records.

People Also Read: Rates of Stamp Duty on Gift deed across Some Prominent Cities Of India

Time Limit to Cancel a Gift Deed

The limitation period to file a cancellation suit depends on the ground:

| Ground | Time Limit (as per Limitation Act, 1963) |

|---|---|

| Fraud or Coercion | 3 years from the date of discovery |

| Non-fulfilment of Condition | 3 years from date of breach |

| Incompetency of Donor | No specific limit but must act promptly |

| Forgery or Illegality | 3 years from discovery |

| Mutual Agreement | No limit, but recommended to do promptly |

People Also Read: Gift Deed: All you should know.

Important Case Laws on Gift Deed Cancellation

1. Krishnamurthy vs. Thulasi (2021) – Madras HC

The court allowed revocation of a Gift Deed due to failure by the donee to fulfil the condition of caring for the donor.

2. Renuka vs. Ramanna (2022) – Karnataka HC

Held that undue influence by a son to obtain a property gift from his elderly mother was valid ground for cancellation.

3. Gomtibai vs. Mattulal (1996) – Supreme Court

SC ruled that the donor must prove non-delivery of possession for cancellation to succeed.

Precautions While Executing a Gift Deed

To avoid future disputes:

-

Always mention conditions clearly if the gift is conditional.

-

Ensure proper registration and stamping.

-

Donor and donee should sign in the presence of witnesses.

-

Prefer video recording or photographic evidence of intent and delivery.

-

Consult a lawyer before execution.

People Also Read: High Court Empowers Elderly: Parents Can Revoke Gift Deeds If Neglected by Children

Conclusion

A Gift Deed is a noble and irrevocable gesture—but only when done legally, fairly, and with full consent. If the donor has been misled, coerced, or if the donee violates stated conditions, the law offers remedies.

However, cancelling a Gift Deed involves a formal legal process, supporting evidence, and judicial approval. The time limits are strict, and professional legal help is crucial for a successful outcome.

Whether you're a donor reconsidering your decision or someone facing disputes over a gifted property, understanding your rights and obligations is essential to avoid costly litigation and protect your assets.

Frequently asked questions

Can a registered Gift Deed be cancelled without going to court?

Can a registered Gift Deed be cancelled without going to court?

Yes, but only if both donor and donee agree mutually and sign a Cancellation Deed, which must also be registered.

What if the donee refuses to return the property?

What if the donee refuses to return the property?

If there's no mutual agreement, the donor must file a civil suit for revocation based on legal grounds like fraud, coercion, or violation of conditions.

Is stamp duty refundable after cancellation of Gift Deed?

Is stamp duty refundable after cancellation of Gift Deed?

Stamp duty is usually non-refundable. However, some states allow partial refunds in specific situations. Check with your local registrar’s office.

Can legal heirs challenge a Gift Deed?

Can legal heirs challenge a Gift Deed?

Yes, if they prove the donor was not competent, was under influence, or the gift was executed fraudulently.

Can oral gifts be cancelled?

Can oral gifts be cancelled?

Oral gifts of immovable property have no legal standing unless registered. Hence, cancellation is not needed—they are invalid from the beginning.

Trending

Frequently asked questions

Can a registered Gift Deed be cancelled without going to court?

Can a registered Gift Deed be cancelled without going to court?

Yes, but only if both donor and donee agree mutually and sign a Cancellation Deed, which must also be registered.

What if the donee refuses to return the property?

What if the donee refuses to return the property?

If there's no mutual agreement, the donor must file a civil suit for revocation based on legal grounds like fraud, coercion, or violation of conditions.

Is stamp duty refundable after cancellation of Gift Deed?

Is stamp duty refundable after cancellation of Gift Deed?

Stamp duty is usually non-refundable. However, some states allow partial refunds in specific situations. Check with your local registrar’s office.

Can legal heirs challenge a Gift Deed?

Can legal heirs challenge a Gift Deed?

Yes, if they prove the donor was not competent, was under influence, or the gift was executed fraudulently.

Can oral gifts be cancelled?

Can oral gifts be cancelled?

Oral gifts of immovable property have no legal standing unless registered. Hence, cancellation is not needed—they are invalid from the beginning.

Ask a Lawyer